Akhuwat Loan Helpline

+92-326-289-8353

Akhuwat Loan Features

Quick Approvals

Contact our team to get interest free Loan.

No Extra Fees

Interest free Loan no extra Fees.

Flexible Payments

Get Interest Free Flexible Loans

| Loan Amount | Time Period | Monthly Installment |

|---|---|---|

| 50,000 | 01 YEAR | 4,400 EMI |

| 100,000 | 01 YEAR | 4,400 EMI |

| 500,000 | 05 YEARS | 4,400 EMI |

| 1,000,000 | 10 YEARS | 5,600 EMI |

| 1,500,000 | 10 YEARS | 5,600 EMI |

| 2,000,000 | 10 YEARS | 5,600 EMI |

| 3,000,000 | 10 YEARS | 5,600 EMI |

| 5,000,000 | 15 YEARS | 5,600 EMI |

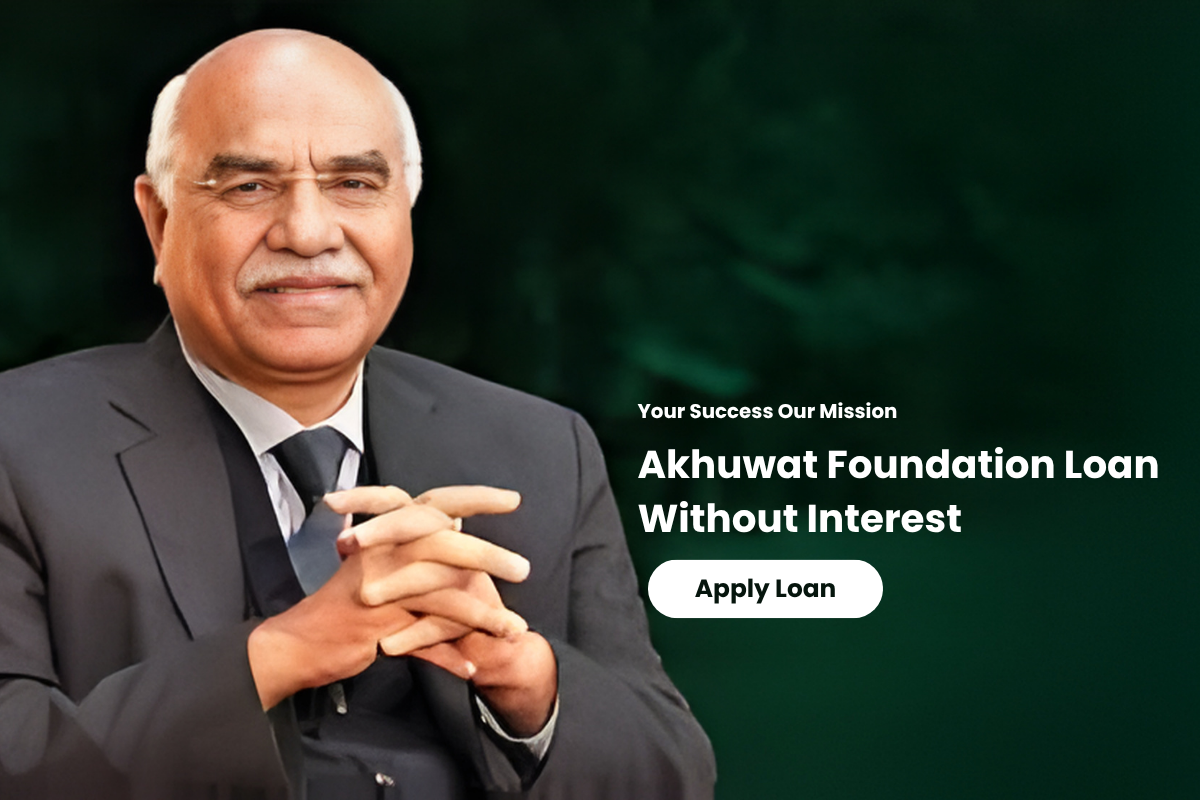

Who We Are ?

Akhuwat Foundation stands as Pakistan’s pioneering institution in ethical, interest-free financing (Qarz-e-Hasna), dedicated to empowering individuals and nurturing sustainable communities. Unlike traditional banks, our approach is guided by compassion, transparency, and a commitment to social uplift — not profit. Through accessible, dignified financial support for education, business, housing, and healthcare, Akhuwat continues to build a Pakistan rooted in equality, trust, and shared prosperity.

Support Services by Akhuwat

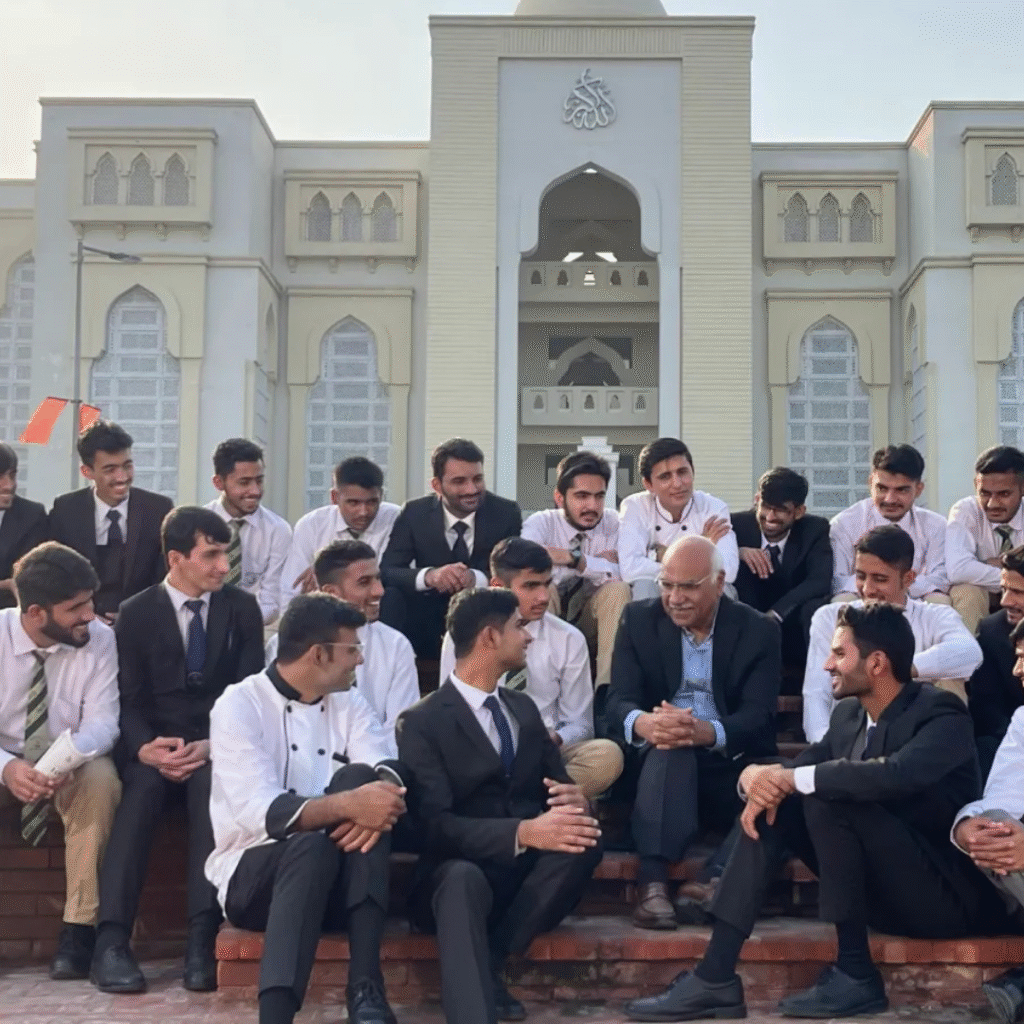

Akhuwat empowers low-income families by offering interest-free loans and essential support services including education, healthcare, housing, skill development, and more — helping them build sustainable, independent lives.

Interest Free Loan

Education Support

Healthcare Assistant

Clothing Bank

Hosuing Project

Skill Development

Akhuwat Foundation Loan

Empowering You Through Interest-Free Financing

Welcome to the Akhuwat Foundation Loan Program – your gateway to financial empowerment and dignity. In a world where financial hurdles can limit potential, Akhuwat stands with you. Through interest-free loans, we support hardworking individuals, students, entrepreneurs, and families to overcome financial barriers and achieve their dreams. Join a movement that believes in compassion, community, and creating lasting impact — one loan at a time.